Last Updated on June 12, 2023

Owning a construction business comes with its own set of unique challenges, one of which is funding and supporting your business and knowing how to save money. Luckily, there are several grants and incentive programs for businesses within the construction industry. With that said, finding the grants your business is eligible to receive can be rather time-consuming and burdensome (especially because time=money). If your business is located in the US, you’re in the right spot!

If your business is located in Canada, check out our Canadian money-saving tips article.

We’ve compiled the ultimate resource list to help you save money as a service and construction business in the U.S. This list of federal and privately funded grants and tax credits will help you reduce your costs and increase your profit margins.

We have included grants, rebates and tax credits for every size of business. When reviewing them, keep in mind that qualification for certain grants and credits are dependant on the size of your company. Make sure you review the business size requirements for each program, and confirm that your business is eligible.

Keep reading to find out what kinds of federal and private grants are available to service and construction companies like yours and start the application process today!

Federal Grants and Tax Credits for Your Construction Business

The following list includes federally supported grants for businesses. These grants are awarded monthly, quarterly, or yearly and can help you reduce out-of-pocket construction costs.

- Small Business Innovation Research Program (SBIR): An awards-based grant program offered to small businesses committed to scientific and technological innovation.

- Small Business Technology Transfer (STTR): Similar to the SBIR, qualifying small businesses can apply to this awards-based grant program if they partner with eligible non-profit organizations to explore scientific and technological innovation.

- U.S. Economic Development Administration (EDA): The EDA offers funding opportunities for projects supporting regional and national economic development.

- Women-Owned Small Business (WOSB) Federal Contracting Program: A federal government award that helps support women-owned small businesses with the goal of offering equal opportunity to women in business.

How to Find Additional Federal Grants

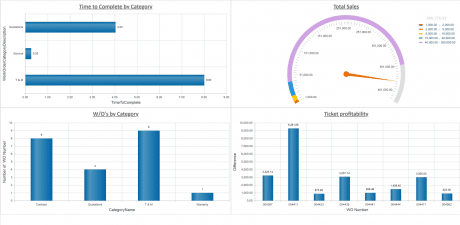

Grants.gov is a great resource for finding federal business grants. You can search through the database by filtering and narrowing your search to find a grant opportunity that fits your construction company.

- The 179D Commercial Buildings Energy Efficiency Tax Deduction: A tax credit for building owners, contractors, energy service companies, and specialty sub-contractor who install qualifying systems in buildings that improve energy efficiency.

- Employee Training Incentive Program: A tax incentive for New York State employers who improve the skill and productivity of their employees, including internship programs.

- Worker Retraining Tax Credit: A training tax credit that reimburses up to 30% of costs for eligible worker retraining.

- Employment Training Panel: A funding program available to employers who train and upgrade the skills of their employees in California.

- Bluegrass State Skills Corporation: Kentucky State offers two programs for employers who train and upgrade the skills of their employees. Eligible Kentucky businesses can apply for the Grant-in-Aid (GIA), a program that reimburses employers for occupational and skills upgrade training. The Skills Training Investment Credit (STIC), is an income tax credit for companies that provide approved training programs.

New grants are added all the time, so keep checking back for new funding opportunities!

Private Grants and Tax Credits to Help Your Construction Business Save Money

Privately funded grants are another way construction companies can keep more money in their pocket.

- The Barstool Fund: A grant offered to small businesses affected by the COVID-19. To qualify, you must prove you kept on many employees throughout the pandemic and have a proven track record of success.

- GoFundMe Small Business Relief Fund: Qualifying small businesses affected by COVID-19 that raise at least $500 through a GoFundMe campaign will be eligible for a $500 grant.

- Nav’s Small Business Grant: A quarterly grant based on customer voting, with a grand prize of $10,000.

- Amber Grant Foundation: A grant offered to women entrepreneurs. Each month $10,000 is awarded to the winner, with an additional $25,000 awarded in December.

- BIPOC Small Business Grant by Annuity Payment Freedom: A micro-grant awarded to BIPOC-owned businesses who were affected by COVID-19.

- In addition, construction companies can take advantage of R&D tax credits to save money.

How to Find Additional Private Grants

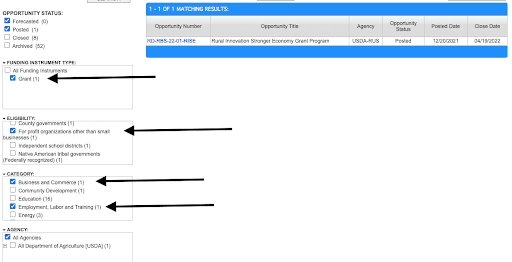

Grant Watch is a great website to search for small business grant opportunities at the local, state, federal, and corporate levels. You will need to pay to become a member to view full eligibility requirements.

When narrowing down your search, select ‘Small Business’ for the recipient. For the location, select either United States, or your desired state. For the category, select ‘Business.’ Remember to pay attention to the grant deadline!

More Ways to Save Money

This comprehensive list showcases how many opportunities are available to help your service and construction business save money. Businesses across the country have been negatively impacted by the pandemic, but support is available to help fund your business and reduce out-of-pocket operating costs.

Improving efficiency and saving money for the service and construction industry can also be achieved by investing in technology. Construction management software is another tool available to help you reduce construction costs and increase cash flow.

At Jonas Construction, we offer industry-leading ERP software to help your construction business maximize profitability. Our software helps with accounting, service management, project management, and operations to increase accuracy and streamline your workload. We can help you eliminate tedious manual administrative tasks, increase accuracy, and boost productivity to support your bottom line!

Contact us or request a demo today to see how your construction business can keep more money in your pocket with Jonas Construction Software.