Last Updated on July 17, 2023

Calling all construction and service businesses in Ontario, Canada! This article is for you.

Ontario has a thriving construction industry that represented 7.2% of the province’s GDP in 2020 (Building). But, how do you ensure that your construction company outperforms the rest? It’s important to keep a close eye on the current state of the industry so your business can successfully pivot and continue to dominate in your field.

In the coming decade, it will become increasingly important to adjust to industry trends and adopt the right solutions to save time and money and improve your bottom line. To help you stay ahead, we’ve compiled a list of 40+ must-know Ontario construction industry statistics.

Keep reading until the end of the article to learn the Ontario construction industry’s greatest challenge and the best way for your business to overcome this problem in the coming years.

General Outlook of Ontario’s Construction Industry

Despite a difficult year for the majority of the industries in Canada, Ontario’s construction industry wasn’t too shaken by COVID-19. Even with the threat of a global pandemic, the industry still reported high levels of employment and general industry growth. In fact, the entire industry has been rising steadily since the early 2000s. As the pandemic (hopefully) starts to die down in Ontario due to rising vaccination rates, we also expect a greater increase in construction projects across the board.

Here are some statistics that best demonstrate the Ontario construction industry’s resilience and hope for the future:

- Ontario’s construction industry grew by 0.3% compared to 2019, amounting to $50.9 billion. (Building)

- Between 2002-2017, the Ontario construction industry has grown by 50%. (BuildForce Canada)

- An estimated 413,600 people are currently employed in Ontario’s construction industry, split almost evenly between residential and non-residential construction. (BuildForce Canada)

- The Ontario construction industry currently requires close to 50,000 workers. (BuildForce Canada)

Residential Building Construction

Residential construction in Ontario saw some of the most surprising growth over the previous year and activity in the housing market has been trending upwards over the last decade.

The following statistics demonstrate that the future looks bright for those involved in remodelling, renovation, or construction of new homes, condos, and apartments.

- The residential sector’s GDP grew by 4.4% in 2020. (Building)

- Between 2016-2021, the average growth was 1.8% (IBISWorld)

- In 2017, housing starts surpassed 80,000 units province-wide. (BuildForce Canada)

Non-Residential Construction

In the non-residential construction sectors, growth wasn’t quite as consistent. Although the industrial/commercial/institutional (ICI) sector saw impressive growth over the last year, it was accompanied by massive losses in other construction activities. The statistics below speak more to these trends.

- The GDP of Ontario’s ICI construction sector (including industrial, institutional, and commercial construction) increased by 3.6% in 2020, up to $8.9 billion. (Building)

- The GDP of engineering and other construction activities fell by 9.1% compared to 2019. (Building)

Regional Construction Industry Statistics in Ontario

As one of the largest provinces in Canada, it’s no surprise that Ontario’s construction industry varies greatly depending on the region. In the following sections, we’ll discuss the construction industry statistics for each region in Ontario, so you can see whether or not your construction company is operating in the most profitable location. You’ll also gain insight into whether your business needs to pivot in order to stay competitive and protect your bottom line.

Greater Toronto Area (GTA)

In the past few years, the GTA has experienced considerable immigration and population growth, leading to a strengthened economy and rising housing prices. There has also been a recent increase in both commercial and major residential condo starts in the area. However, despite the growth potential of the industry, only 32% of contractors say that they are optimistic for added business in GTA (BuildForce Canada). On the other hand, 50% of the firms operating in GTA report that their economic outlook is good (Ontario Construction Report), which is the highest in the province!

Residential Sector

- Housing starts are expected to rise to 46,000 units by 2023. (BuildForce Canada)

- In 2017, renovation work increased from 51% to 57% of total residential construction employment in the GTA. (BuildForce Canada)

- Overall employment in residential construction is expected to rise by 8,800 jobs by 2027 – an 8% increase from the 2017. (BuildForce Canada)

Non-Residential Sector

- From 2017-2019, an additional 3,000 workers were required due to major engineering and infrastructure projects (BuildForce Canada)

- ICI (industrial, commercial, institutional) building construction contributed 3,400 new jobs between 2018 and 2020 (BuildForce Canada)

- From 2017-2027, non-residential employment requirements are expected to rise by 11% (BuildForce Canada)

Central Ontario

Compared to GTA, construction companies in central Ontario are slightly more optimistic but report a slightly lower economic outlook. 34% of contractors say that they are optimistic for added business (BuildForce Canada) and 47% of the firms operating in Central Ontario report that their economic outlook is good (Ontario Construction Report). In Central Ontario, residential, institutional, and commercial construction are all expected to show continued growth in the coming years.

Residential Sector

- In 2017, housing starts grew from 10,500 in 2013 to 18,500 units (BuildForce Canada)

- In 2019, employment declined 7% but it is expected to return to previous rates by 2023. (BuildForce Canada)

Non-Residential Sector

- Between 2017-2027, there is an expected 8% increase in jobs (4,400 jobs added) (BuildForce Canada)

Eastern Ontario

Compared to all other regions in Ontario, Eastern Ontario construction companies report the worst economic outlook, with only 15% reporting that their economic outlook is good (Ontario Construction Report). Almost triple the amount of construction companies report a positive economic outlook in all other regions in the province. The stats below explain the reduced optimism in this region, with reduced employment in both the residential and non-residential sectors.

Residential Sector

- Housing starts have increased 45% since 2010. (BuildForce Canada)

- Housing starts are expected to reach 10,000 units by 2022. (BuildForce Canada)

- Employment was expected to decrease by 2500 jobs in 2019, and rise to peak by 2023. (BuildForce Canada)

Non-Residential Sector

- Institutional construction is a key driver towards an upward trend in employment, with 500 new jobs from 2017-2020. (BuildForce Canada)

- Total employment rose by 6% from 2017-2020 but is expected to gradually decrease by 2027 back to 2017 levels with the completion of major products. (BuildForce Canada)

Northern Ontario

After looking at the lack of optimism in Eastern Ontario, the stats on construction companies in Northern Ontario are much more promising. Northern Ontario construction companies report an average economic outlook, with 35% of construction firms reporting that their economic outlook is good (Ontario Construction Report). Following several years of reduced employment and declining levels of residential investment, Northern Ontario can expect to see modest growth in new housing developments and ICI construction.

Residential Sector

- Housing starts recovered to above 1,000 units in 2017 and are expected to average between 1,300 units in the coming years. (BuildForce Canada)

- Renovation and maintenance work accounted for 7 in 10 residential jobs in 2017 (BuildForce Canada)

Non-Residential Sector

- Overall non-residential employment requirements are expected to slow, resulting in 550 jobs lost by 2027 (BuildForce Canada)

Southwestern Ontario

Finally, southwest Ontario also reports a decent economic outlook with 34% of firms reporting that their economic outlook is good (Ontario Construction Report). This optimism is likely due to the 6% rise in total construction (3,300 new jobs) from 2017-2020 (BuildForce Canada). Unfortunately, construction employment is expected to recede to 2017 levels by 2027. Although moderate declines are expected in residential construction in the coming years, this will be partially offset by increased levels of ICI construction in Ottawa and the rest of the region.

Residential Sector

- Housing starts doubled from 2011-2017, reaching 8,000 units. (BuildForce Canada)

- By 2027, overall employment is expected to decline by 3,900 jobs, as new housing activity slows (BuildForce Canada)

Non-Residential Sector

- From 2017-2020, employment increased by 4800 new jobs. (BuildForce Canada)

- From 2017-2020, ICI building construction requirements raised demands by 2,600 jobs before cycling down in 2021. (BuildForce Canada)

The Industry’s Biggest Challenge: Replenishing an Aging Workforce

As you can tell by the majority of the statistics above, construction employment is a major concern in the Ontario construction industry. In addition to employment rates dropping in some areas, construction and service businesses are also facing employment issues due to an ageing workforce.

The industry must make a conscious effort to recruit enough skilled workers to keep up with the rising demands in the next decade. As more skilled construction and service workers retire, construction companies and the Ontario construction industry as a whole need to either focus on recruitment and training additional workers or find new ways to improve efficiency (such as investing in ERP software!)

These statistics elaborate on the employment issues faced by the Ontario construction industry:

- Due to retirement, Ontario will require 87,300 new construction workers from 2017-2027. (BuildForce Canada)

- From 2018-2027, only 84,300 new entrants are expected in the industry (BuildForce Canada)

- The average age of Ontario’s construction workforce = 41 years by 2027 (BuildForce Canada)

- 20% of the current workforce will be lost by 2027 due to retirement (BuildForce Canada)

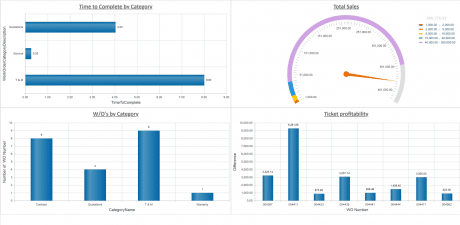

Meet Rising Demands & Manage Labour Shortages with Jonas Construction Software!

So, as construction demands increase after the COVID-19 pandemic and employment issues become a growing challenge, how will your construction business get ahead? First, we need to consider a few different scenarios:

If your construction business operates in a region or sector where employment and construction investments are expected to increase, you’ll need to find a way to take on more work and scale your business. Investing in the right construction software can help you increase efficiency to meet rising demands.

If your construction company operates in a region or sector where employment and construction investments are expected to decrease, you’ll need to find unique ways to stand out from your competition and improve customer service. Investing in construction software is a great way to give your employees the tools they need to improve customer satisfaction and increase repeat business.

At Jonas Construction, we provide a cloud-based accounting, project management, and service software platform that is specifically designed for the needs of the construction industry. Our software can help you automate processes to improve efficiency, increase profitability, and provide you with the insights you need to scale your business. Contact us or request a demo today!