Last Updated on July 4, 2024

If you are a construction business owner or investor, you may already be familiar with construction bonds. Construction bonds play a crucial role in the bidding process for construction projects, but also reflect how well a contracting business operates its business and achieves its profitability. Having a strong public reputation is not only essential for winning more projects, but also for attracting more skilled and talented employees.

What Are Construction Bonds? Construction bonds are a type of surety bond implemented prior to the start of a construction project. The acts as a guarantee to the investor(s) or project owner(s) that the construction project will meet the specific parameters outlined in the contract.

A surety bond involves three parties to participate:

- Guarantor – An individual or organization (insurance/surety company) that guarantees payment to the obligee for any losses or debt incurred from the contractor.

- Obligee – The investor(s) and/or project owner(s) of the construction project.

- Contractor – The individual and/or business responsible for completing a specific construction project.

Constructions bonds protect the investor/project owner against financial loss and delays, due to any errors, lack of project management or failure to abide by the agreed terms on the contractor’s part. Employees, suppliers, sub-contractors and other clients involved in the construction project are also protected under construction bonds.

Construction bonds are available in a variety of types as well. Here are some more commonly used construction bonds:

Bid Bonds Bid bonds are used during the tendering process to help increase a construction business’ chances of winning a bid. The bid bond acts as an insurance to the investor or project owner that the contractor will start and complete the project if they win the bid. Bid bonds also inform the investor/project owner that the contractor is financially stable enough to follow through with the construction project they’re bidding for. Bid bonds are generally priced based on the scope of work, amount bid for the projects and terms of the construction project.

Performance Bonds Performance bonds are generally what most people think of when you think of construction bonds. They protect the project owner/investor from any financial loss if the work completed by the contractor is not up to standards, quality or specifications agreed in the initial contract. The performance bond would cover the cost to redo or repair any work that does fulfill the agreed terms.

Payment Bonds Contractors use payment bonds to ensure their subcontractors and suppliers that they will be paid for their services and materials. They are used often used with performance bonds.

Why Are Constructions Bonds Important for Your Construction Business?

During the tendering process, investors and project owners will consider a number of factors when weighing your construction businesses over your competition. Aside from your bid price, offering a construction bond with your bid will reassure the project owner/investor that your business is financially viable and stable enough to carry out the work your business proposes in your agreement.

In order to qualify for construction bonds, the surety/insurance company must also evaluate the contractor based on their construction aptitude, resources, experience and reliability to carry out the specifications according to the contract. They also research a contractor’s financial statements, financial standing, credit rating and work history.

With such extensive research required to obtain a construction bond, investors/project owners can be confident that any contractor offering a construction bond is a legitimate and trustworthy company. Having a construction management software that helps generate bonding reports approved by surety companies will also expedite the bonding approval process for construction businesses. Jonas Construction clients can be confident that their Jonas generated reports are approved and readily accepted during the application process for construction bonds by Trisura Guarantee Insurance Company.

What is the Process for Applying for a Construction Bond?

Investors and/or Project Owners will often request for a construction bond prior to commencing a construction project to protect their investment. The process for applying for a construction bond can be quite lengthy and should be started as early as possible if you are unfamiliar with the application process.

- Decide on what category of construction bonds you will require for the project you’re bidding for. If an investor/project owner does not request for a bid bond during the bidding process, many contractors will simply wait until they are awarded the project to apply for the performance bond. From there, a contractor may also consider applying for a payment bond as well.

- Qualifying for Construction Bonds Every country will have their own legislative body, which governs the underwriting guidelines for qualifying for a surety/construction bond. You may want to consider researching a surety broker that will offer bonds nationwide or across North America to ensure you are protected for whatever area you work in. Contractors must submit an application and

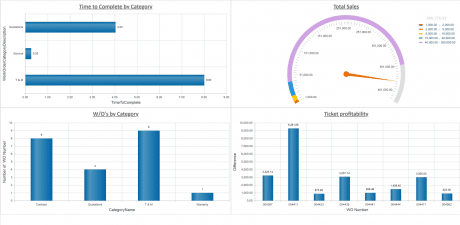

questionnaire to determine their eligibility during the prequalifying stage. - Be Prepared to Demonstrate an Organized and Profitable Contracting Business In addition to providing a well-written business proposal and scheduling of work for the proposed construction project, you will also want to provide the surety company concrete proof through valuable data and reporting. To help you save precious time and energy to organize such reports and data, many contracting businesses will invest in construction management software that not only helps them manage their business, but their project management as well. An all-in-one construction management solution should be robust enough to handle all areas of your business, including reporting financial and project statuses. If you are looking for a construction management solution, customized reports that present information on specific parameters and areas of your business are also indicators of a strong construction management platform. Additional reports a surety company may review include WIPs (work in progress), forecasting reports, inventory reports, etc. A surety company will review applications based on these reports, which is why it is so important to ensure that the reports you submit are clear, accurate and sufficient.

- Get a Construction Bond Quote The price you pay for a construction bond will depend on how much you want to be bonded for. The more you wished to be bonded for, the higher the price. A surety company will be able to provide you with a quote based on the bonding amount you need. The premium you pay will be based on your financial standings; therefore, companies with better credit ratings may get a rate ranging anywhere from 1% to 5%, while companies with poor credit may pay up to 20%.

To learn more about Jonas’ bonding reports approved by Trisura Guarantee Insurance Company, leave us a comment below or speak to one of our account representatives.